DOVER- A bipartisan committee of Senators and Representatives convened in Dover Tuesday morning for the fourth in a series of hearings aimed at investigating Delaware’s recent statewide property reassessment.

This hearing was focused on the impacts of the reassessment process on businesses, manufactured housing, and multi-family homes and included presentations by representatives from several professional organizations, including the Delaware Apartment Association, Delaware Association of Realtors, Greater Wilmington Housing Providers, Delaware Manufactured Home Owners, Delaware Restaurant Association, Delaware Farm Bureau, and Delaware Association for the Education of Young Children (DEAEYC).

In August, the General Assembly passed legislation that allowed school districts to set different tax rates for residential and non-residential properties following widespread reports that non-residential properties were underassessed, while residential properties were overassessed in New Castle County.

The legislation was challenged by a group of landlords and property associations in the Court of Chancery, but it was ultimately upheld by both the Court of Chancery and the Delaware Supreme Court. Despite this ruling, the special committee organized Tuesday’s hearing to better understand the impacts of reassessment on non-residential property owners.

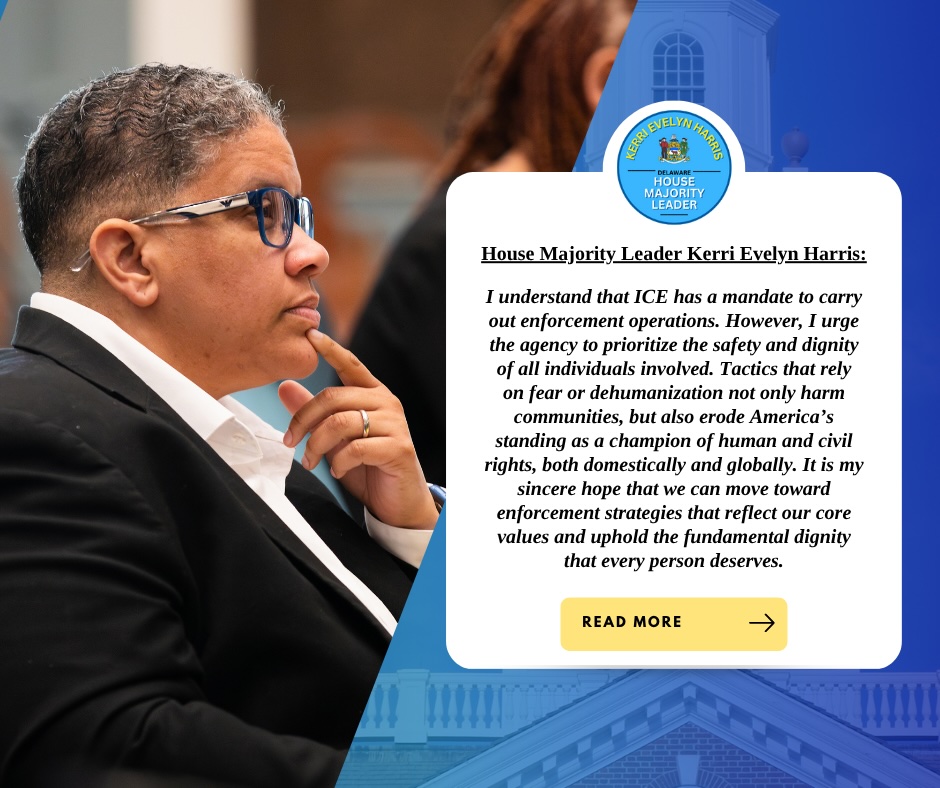

“From the beginning, our committee has made it a priority to hear from as many voices as possible so that we can craft solutions grounded not in theory, but in lived truth,” said Majority Leader Kerri Evelyn.

“Businesses are just as affected by reassessment as homeowners, and when we ignore that, the whole community feels it. The hearing today gave us the opportunity to listen to their concerns, learn from their experiences, and work toward a reassessment process and property tax structure that’s fair, understandable, and sustainable for everyone. I’m grateful to all who shared their perspectives and contributed to this important work.”

Key findings from the housing sector:

- Each representative from the housing associations argued that taxing properties at the non-residential rate drives up costs for renters and manufactured homeowners since these higher taxes are often passed on to tenants.

- Jerry Heisler, speaking on behalf of the First State Manufactured Housing Association testified that many manufactured homes were over-assessed, in some cases by more than nine times their real value.

- The Realtors Association claimed that many non-residential property owners had difficulty obtaining assessment appeals hearings.

- On behalf of the Delaware Manufactured Home Owners Association (DMHOA), which advocates for manufactured homeowners, Joyce O’Neal explained that residents not only cover the landowner’s taxes through their lot rent but also pay taxes on the assessed value of their homes. With rising costs, she said, it’s becoming increasingly unaffordable for many homeowners.

- Dave Weglinski, a member of DMHOA, spoke on behalf of the senior communities living in manufactured homes. He shared his personal experience with rising costs in the Wild Meadows Manufactured Home Community, and concerns on how the reassessment will affect lot rates in 2026. He argued that for seniors on fixed incomes, rising healthcare costs, historic inflation, and surging housing costs alongside the increase in taxes will lead to a monthly deficit for many seniors.

Key findings from the small business sector:

- Jamie Schneider, Executive Director of the Delaware Association for the Education of Young Children (DEAEYC), shared her concerns on the impact of property tax increases on childcare businesses. She argued that increasing taxes on small, local businesses specifically will have negative impacts on workforce stability, accessibility, and quality of care.

- The Delaware Restaurant Association (DRA), representing one of the largest small business sectors in the state, noted that restaurant owners are currently dealing with an increase in expenses due to factors such as rising healthcare premium costs and higher tariffs on goods. Without more transparency and predictability in tax increases, DRA President & CEO Carrie Leishman argues that businesses will go under.

- The agricultural industry, which employs 1 in 8 Delawareans, was represented by the Delaware Farm Bureau. They highlighted many farmers’ experiences throughout the reassessment process, including triple-digit increases on farm parcels, unfair taxation of farm structures, and inconsistencies within farm classification. As a result of higher property taxes, the Farm Bureau argued that farmers are more likely to increase prices on products and activities, reduce capital investments, take on debt, and leave the industry altogether.

The next hearing is scheduled for December 9th at 9:30 a.m. in the Senate Chamber at Legislative Hall.

###